colorado springs sales tax rate

970-384-6445 More Information View Sales Tax Revenue Reports Sales Tax Rates Effective with January 2014 sales tax return the penalty interest rate has changed to 5. Higher sales tax than 74 of Colorado localities 27 lower than the maximum sales tax in CO The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El.

Sales Tax Information Colorado Springs

Colorado Springs CO 80903.

. When you use Revenue Online to file taxes the online form includes all the tax rates for each of your. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Our mailing address is.

January 30 2013 936 AM CBS Colorado. The following forms are provided for reference. Its important to note this does not include any local or county sales tax which can go up to 83 for a total sales tax rate of.

The current total local sales tax rate in Colorado Springs CO is 8200. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county. What is the City sales or use tax rate.

Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle. This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Colorado Springs Colorado is 724.

Effective July 1 2022. 719 385-5291 Email Sales Tax Email Construction Sales Tax. Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Colorado Springs totaling 535.

Method to calculate Colorado Springs sales tax in 2021. 719-385-5291 Investigator Line. Box 1575 Colorado Springs CO 80901.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is 82. Forms DR 1002 DR 0800 DR 0100. 31 rows Colorado CO Sales Tax Rates by City The state sales tax rate in Colorado is 2900.

Sales Tax Division PO. The Colorado CO state sales tax rate is currently 29. The Colorado sales tax rate is currently 29.

307 Construction Use Tax Return 312 Construction Use Tax return Claim for Refund of Sales andor Use Tax on Construction Materials Qualified Entity Information Form Tax Guide. The Springfield Colorado sales tax is 490 consisting of 290 Colorado state sales tax and 200 Springfield local sales taxesThe local sales tax consists of a 200 city sales tax. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

Please call the office to determine the cash deposit amount before mailing. With local taxes the total sales tax rate is between 2900 and 11200. DENVER AP Restaurant sales taxes are likely to stay in place in Colorado even though one Republican wants to make.

Colorado Springs ranked sixth. Depending on local municipalities the total tax rate can be as high as 112. City of Colorado Springs Sales Tax Contact Information.

The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax. Instructions for City of Colorado Springs Sales andor Use Tax Return 307 Sales and Use Tax Return 307 Sales and Use Tax Return in Spanish January 1 2016 through December 31. While Colorado law allows municipalities to collect a local option sales tax of up to 42.

Sales Tax Breakdown Colorado Springs. The license fee is 2000. This is the total of state county and city sales tax rates.

The current sales tax in Colorado is 29. Colorado Springs is located within El Paso. The December 2020 total local sales tax rate was 8250.

Groceries and prescription drugs are exempt from the Colorado sales tax Counties and.

Sales Tax Information Colorado Springs

Atlanta Georgia S Sales Tax Rate Is 8 5

Sales Tax Information Colorado Springs

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Sales Tax Information Colorado Springs

Colorado Department Of Revenue Colorado Gov

Colorado Sales Tax Rates By City County 2022

Sales Tax Information Colorado Springs

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Sales Tax Information Colorado Springs

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

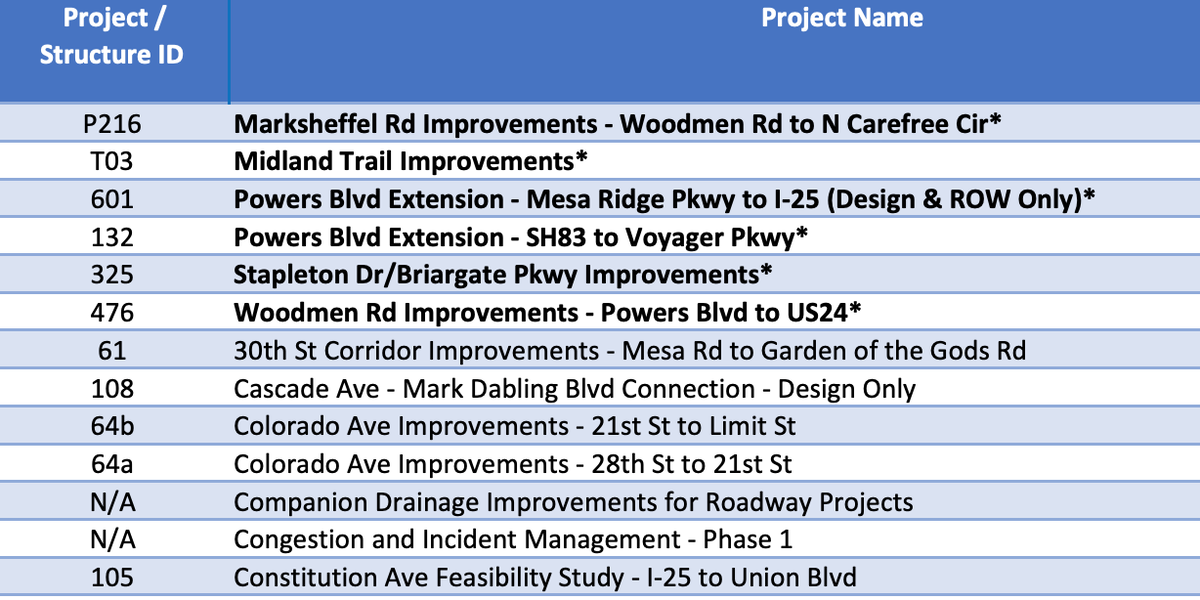

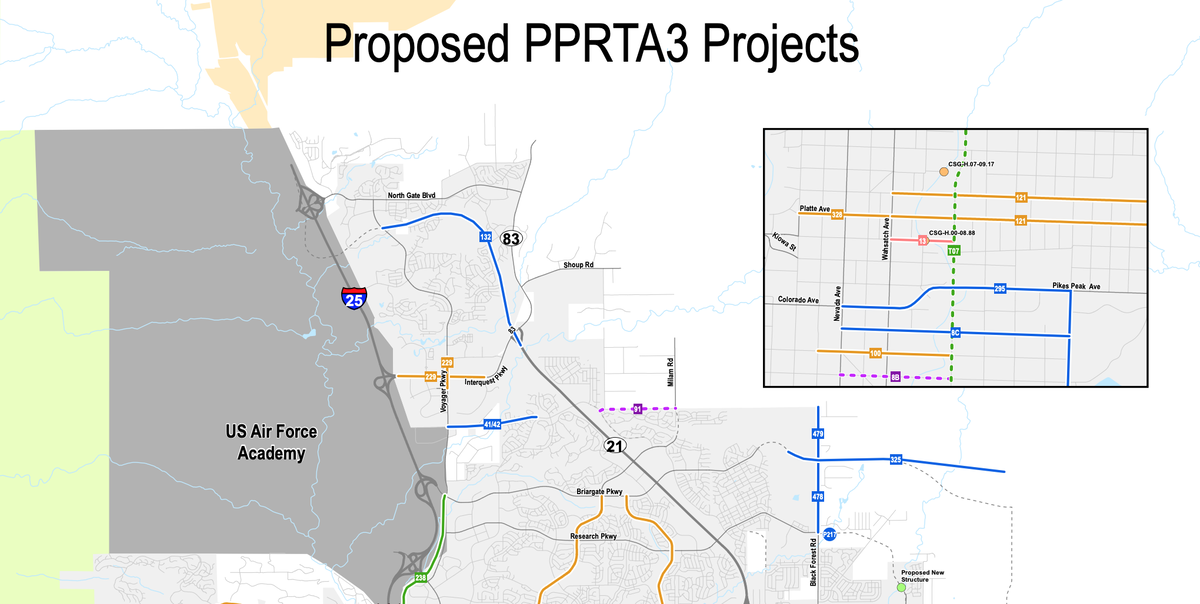

Colorado Springs City Council Discussing Extension Of Pprta Tax For Priority Road Projects Krdo

Sales Use Tax Department Of Revenue Taxation

Sales Use Tax Department Of Revenue Taxation

Kansas Sales Tax Rates By City County 2022

Taxes In Colorado Springs Living Colorado Springs

Sales Tax Information Colorado Springs

Florida Sales Tax Rates By City County 2022

Colorado Springs City Council Discussing Extension Of Pprta Tax For Priority Road Projects Krdo